Exit Strategy Program

A structured process for risk assessment, value driver analysis, and investor-readiness preparation.

Exit Picture™

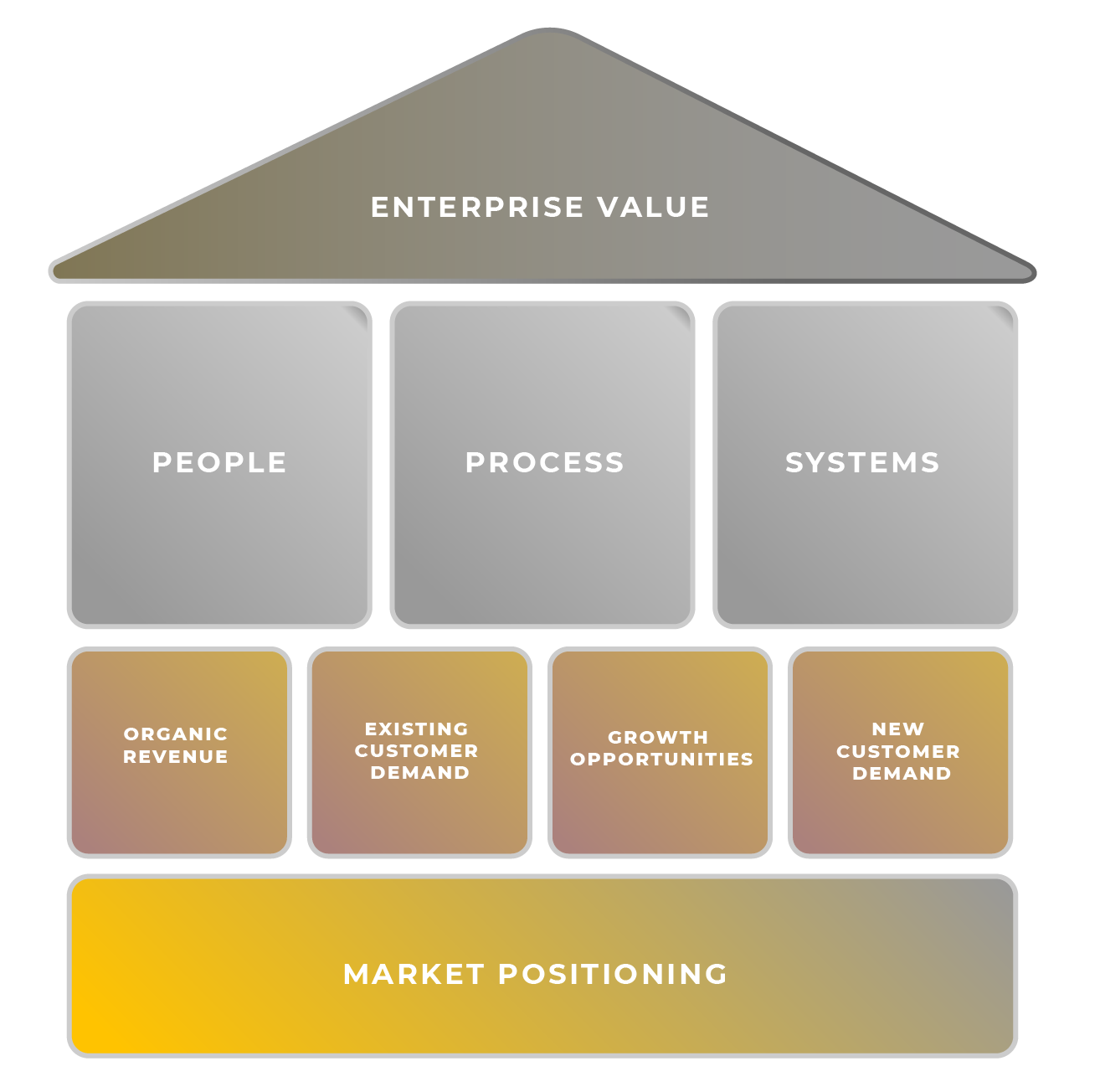

The approach is to develop a picture of the business starting with what it looks like today and then developing a picture of what we want it to look like at exit. The outcome of this Exit Picture™ process is the specification of a target enterprise valueat exit.Exit Mapping™

This target enterprise value is then used to develop an Exit Map™ which blends in the current state, budget target, 3 year target, BHAG target into a map which then overlays what a prospective investor would be thinking at the targeted point of exit.Exit Optimization™

Once we have established the prospective investor’s perspective, we use the AscendX Group’s Exit Optimization Assessment™ to identify the most impactful aspects of the business which could reduce investor confidence and reduce their valuation of the business.

We help our clients position their business to maximize investor confidence and thereby maximize enterprise value.

Investor perceived risk (IPR) drivers

These are the investor perceived risk drivers (43 of them) that comprise the Exit Optimization Assessment™ and enable AscendX Group to stack rank gaps which will most likely reduce the valuations from investors. So, we help our clients position their business to maximize investor confidence and thereby maximize enterprise value.

-

Revenue Visibility

Revenue Consistency/Predictability

Revenue Growth

New Lead Acquisition

New Customer Acquisition

Customer Retention

Customer Purchase Expansion

Customer Concentration

Pricing Stability

Capacity for Price Increases

Inorganic Expansion

-

Growth

Direct

Fixed

-

Historical EBITDA Growth

Profit Margin Range

EBITDA Forecasting/Budgeting Accuracy

EBITDA Adjustments

Return on Invested Capital (ROIC)

-

Market Risk

Market Growth

Market Share/TAM

-

Intensity

Knowledge

Differentiation

Switching Costs

-

Price to Value

Mission Critical

-

Management Team Risk

Talent

Team Cohesion

Performance Management

Key Man Risk

Founder Enthusiasm

-

Financial

Cash Flow Stability

Capital Expenditures

Financial Information

Legal

Structure

Contracts

Activity

Regulatory

Real Estate

Communication